Endowment policy has been in the market for a very long time. However, long term endowment has only started to surface recently in the market with policy maturing at age 100 or even 120/125.

Plans like Prudential Pruwealth, Manulife ReadyBuilder, Etiqa Amplify Flex, Aviva MyLifeSavingsPlan, NTUC RevoGift and AIA Smart Wealth Builder.

A lot of people thinks that Prudential/AIA or other renowned insurance company’s endowment plans are quite decent because their capital is secured and guaranteed, but truth to be told consumers who get policies from an insurance agent or non-independent financial advisor will/may never get the chance to compare due to the agent’s limitations and knowledge of what is out there in the market.

(Check out my other article on independent and non-independent advisors)

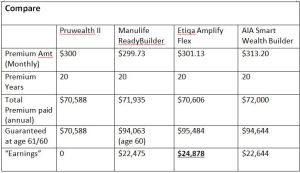

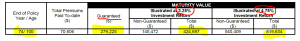

So here is it…… Below example is a 27 year old individual sample.

So the above table shows the guaranteed value at age 60 or 61.

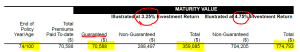

Now, let’s look at age 100/101 of primary life insured, what is the guaranteed cash value?

Let’s see……

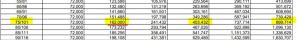

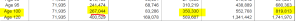

This is Pruwealth II @ age 100, guaranteed whatever you have paid to date. Good enough? Hmmm

Next, AIA Smart Wealth Builder, guaranteed $162,000 @ age 101. Better?

Next, Manulife ReadyBuilder, guaranteed $267,044 @ age 100. Or maybe this is better?

Lastly, Etiqa Amplify Flex, guaranteed $279,225 @ age 100. Or maybe this is even better?

So, for people/consumers out there who think that they have the best plan in the market, think twice, think thrice. Different plans have different pros and cons, good and bad. However, are you getting the most suitable plan for yourself? or is it just because the plan that you got is the only plan your insurance agent can offer?

For more enquiries on plan comparison and enquiries, click/scan here to talk to us directly.

(Jun Kai) https://tinyurl.com/vje5s58

(Grace) https://tinyurl.com/vfaxdmj

– Jun Kai & Grace –